Beginners Guide To Market Indexes: NASDAQ, Dow Jones, & More

We’ve all heard it on the news, “the Dow Jones is down today,” but who is Dow Jones? And why are they down? They’re rookie questions from new investors, but they need answering. Ideally, without all the usual expert technical jargon. First up, what’s a market index?

- A market index is a hypothetical portfolio of investments that have been combined into a single set of values, exactly as if a stock. Those values are then compared to market indicators to determine if a specific sector is up or down, amongst other trends.

- Each market index has a specific purpose and is used to see, at a glance, what sectors might be performing better than others. And ultimately identify where investment opportunities may lie.

- The most popular market indexes are the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite. There’s more on each of these below.

So in the future, when someone refers to “the Dow” know that it is not a specific stock or market. It is just a snapshot of the market, seen through the lens of a hypothetical portfolio.

CHECK OUT: 5 Simple steps to picking stock for investment virgins.

These are the 5 top market indexes:

1. S&P 500

- It is also known as the S&P.

- S&P combines the stock performance of the 500 largest companies listed in the United States.

- Companies include Amazon, Apple, Alphabet (Google), Berkshire Hathaway, and many others.

- The S&P uses a capitalization-weighted index.

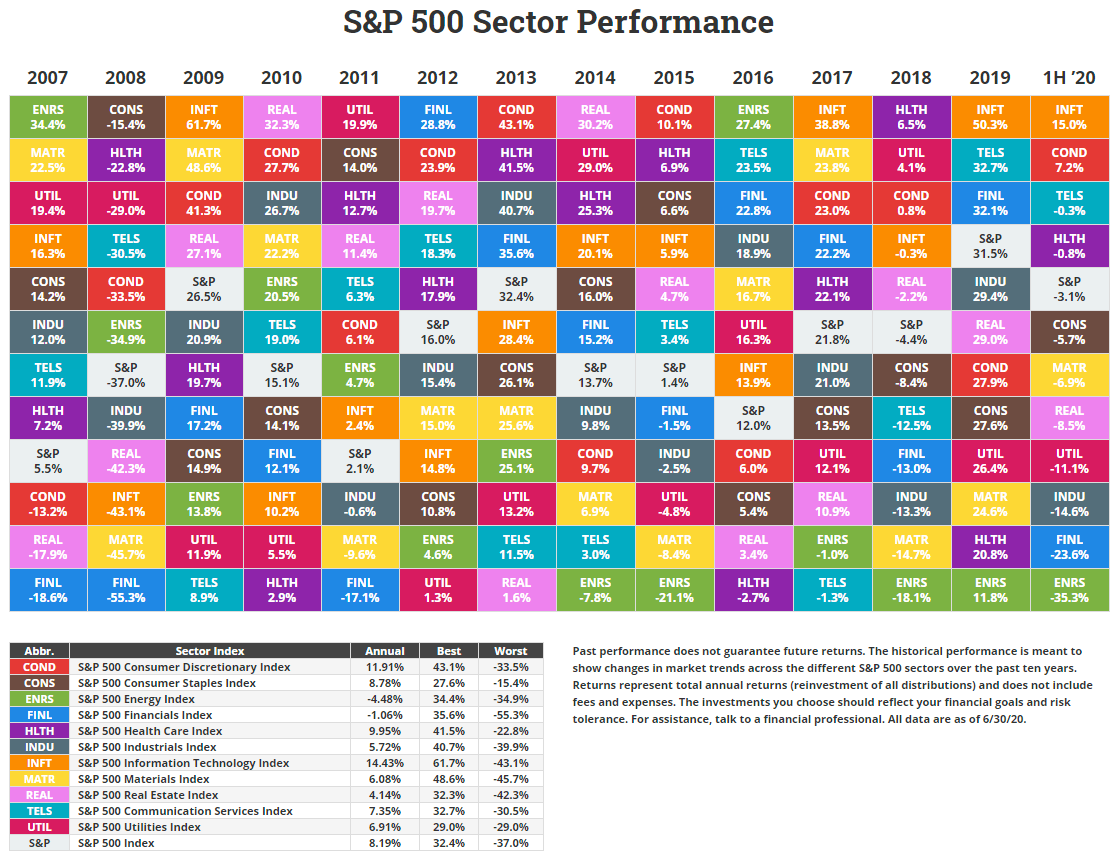

- To put the S&P to use, it is best to focus on the 11 different market indexes setup for different sectors shown below:

Source: novelinvestor.com

Source: novelinvestor.com

2. Dow Jones Industrial Average

- It is also known as the Dow.

- The Dow measures the stock performance of 30 large United States companies. Including Apple, American Express, Caterpillar, and more.

- It is considered to be a narrow representation of the market, hence the S&P is more popular.

- The Dow is calculated by combining stock price and dividing by 0.152. This value changes if one of the 30 companies splits their stock.

- This market index is considered best used as an average for the economy and general market conditions, more-so than any specific sector.

3. Nasdaq Composite

- The Nasdaq composite includes the majority of stocks listed on the Nasdaq stock market.

- Like the S&P, the Nasdaq Composite is a capitalization-weighted index. The calculation involves closing bell stock values, the relative index share that stock has, and then dividing by a index specific value.

- The lesser-known Nasdaq 100, which includes only the largest 100 non-financial companies (on the Nasdaq Composite) drives 90-percent of the Nasdaq Composites market index movement.

- It is heavily weighted toward the information technology sector. Meaning it is a better indication of tech stocks than others.

CHECK OUT: 5 Simple questions to ask yourself before trying short term trading.

4. Russell 1000

- This one is a doozy. The Russell 1000 tracks 1,000 of the highest-ranking stocks on the Russell 3000 index. That’s right, it’s a market index of a market index.

- The Russell 1000 represents 90-percent of the market capitalization of the Russell 3000 index.

- This market index is maintained by the FTSE Russell, a London Stock Exchange Group subsidiary.

- The biggest 10 holdings in the index include Apple, Facebook, JPMorgan Chase & Co., and many others.

- Despite the popularity of the Russell 1000 market index, the Russell 3000 is considered the best way to get a look at the U.S stock market at a glance. This is because it represents almost 98-percent of available stocks.

5. U.S. Aggregate Bond Market

- It is also known as the Bloomberg Barclays U.S. Aggregate Bond Index or the Agg.

- Like others on this list, it is a market capitalization-weighted index. This time for the bond market. Specifically intermediate-term bonds in the United States.

- This market index tracks bonds for corporate debt, government debt, mortgage-backed securities, and asset-backed securities.

- The Agg was once maintained by the Lehman Brothers.

CHECK OUT: 10 Stocks to watch if you’re on a budget of $10 or less.

Other top-rated market indexes to consider:

- S&P 100

- S&P MidCap 400

- Russell Midcap

- Russell 2000

- S&P 600