5 Stocks To Watch This Week: August 26, 2020

Swipe down to see our stocks to watch this week, or check out yesterday’s top-five biggest movers.

#1. Stocks To Watch This Week: Intuit, Inc. (INTU) – $336.42

HEADLINE: Intuit, Inc. (INTU) reported Q4 results on Tuesday and came in higher than the estimates.

- Revenue was reported at $1.82-billion, $246-million above-the-estimate.

- Earnings per share were reported at $1.81 each, $0.76 above-the-estimate.

- Q4 revenue had also increased year over year, by 82.7-percent.

- Plus, Q4 earnings per share had increased year over year by 2111.11-percent.

LATEST TRADING: During after-hours trading INTU increased in value by 6.4-percent. From $336.42 to $357.88.

NEWS SENTIMENT: Before the opening ball on Wednesday Intuit, Inc. had a positive news sentiment of 79-percent, just 1-percent off being bullish.

TRENDS: March 15, 2020, INTU shares were valued at $201.83. By June 28, shares had surpassed their previous 52-week high and were valued at $305.30. Even when looking back over five years, the share value looks to be heading in one direction. Upwards. And that’s why INTU is #1 on our list.

CHECK OUT: Kentucky Fried Chicken tell its customers to hold off on the “finger licking’ for now.

#2. Dicks Sporting Goods, Inc. (DKS) – $46.67

HEADLINE: Dicks Sporting Goods, Inc. (DKS) reported before the bell today and smashed their estimates. Firmly planting it second on our stocks to watch this week list.

- Q2 revenue was reported at $2.71-billion, beating the estimate by $260-million.

- Earnings per share were reported at $3.21 each, beating the estimate by $1.95.

- eCommerce sales were also reported up by 194-percent, year over year.

FLASHBACK: In comparison, Dicks Sporting Goods, Inc. failed to meet estimates during their first-quarter.

- Q1 revenue was reported at $1.33-billion, $157-million below-the-estimate.

- Earnings per share was reported at a loss of $1.21 each, $0.85 worse than the estimate.

LATEST TRADING: During after-hours trading DKS shares increased by 3.6-percent. Rising from $46.67 to $48.35.

NEWS SENTIMENT: Before the opening ball on Wednesday Dicks Sporting Goods, Inc. had a positive news sentiment of 76.66-percent, just 3.34-percent off being bullish.

#3. NetApp, Inc. (NTAP) – $41.77

HEADLINE: NetApp, Inc. (NTAP) will report first-quarter results after the markets close today.

- Analysts estimate that Q1 revenue will be $1.15-billion.

- They also estimate Q1 earnings per share will be $0.41 each.

FLASHBACK: For comparison, NetApp’s Q4 results were a mixed bag.

- Q4 revenue was reported at $1.4-billion, $29-million below-the-estimate.

- Earnings per share were reported at $1.19 each, $0.04 above-the-estimate.

LATEST TRADING: During after-hours trading NTAP shares increased by 0.8-percent. Moving from $41.77 to $42.10.

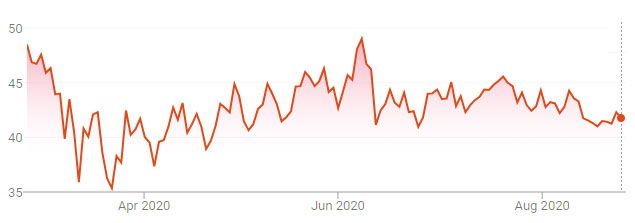

What makes NetApp, Inc. so interesting is its volatility. Check out the six-month share value below.

CHECK OUT: Remaining Virgin Atlantic creditors back $1.6-billion plan.

#4. Urban Outfitters, Inc. (URBN) – $20.80

HEADLINE: Urban Outfitters, Inc. (URBN) reported surprise Q2 results on Tuesday, beating-the-estimate handsomely despite significant falls in revenue and earnings per share year over year.

- Q2 revenue was reported at $803.27-million, $130.64-million above-the-estimate.

- Q2 earnings per share were reported at $0.35 each. $0.75 above-the-estimate.

- Revenue was 16.53-percent lower than the same quarter last year.

- Earnings per share were 42.62-percent lower than the same quarter last year.

LATEST TRADING: During after-hours trading URBN shares increased in value by 12.6-percent. From $20.80 to $23.43.

This surge shows URBN climbing towards a pre-lockdown value of $28.61. The big question is, how far will the market take it? This is why it makes our top five stocks to watch this week.

#5. Williams-Sonoma, Inc. (WSM) – $95.41

HEADLINE: Williams-Sonoma, Inc. (WSM) will report second-quarter results after the markets close today.

- Analysts estimate that Q2 revenue will be $1.46-billion.

- They also estimate Q2 earnings per share will be $0.99 each.

- August 21, Gordon Haskett upgraded their status from Accumulate to Buy on WSM. Setting a $110 target.

LATEST TRADING: During after-hours trading WSM shares increased by 2-percent. Rising from $95.41 to $97.23.

NEWS SENTIMENT: Before the opening ball on Wednesday Williams-Sonoma, Inc. had a positive news sentiment of 78.27-percent, just 1.73-percent off being bullish.

With news so close to being bullish and a $110 target, WSM had to be one of our stocks to watch this week.

CHECK OUT: American Airlines to cut 19,000 jobs in October without aid as workforce shrinks by 30-percent.

Yesterday’s Biggest Movers

#1. FTS International, Inc. (FTSI) was the fifth biggest mover on Monday and is Tuesday’s #1. Their 36.5-percent fall from $5.00 to $3.15 on Monday was followed by a 38.4-percent surge on Tuesday, from $3.15 to $4.36. This volatility was down to a reported agreement to restructure $400-million of debt to equity.

#2. BigCommerce Holdings, Inc. (BIGC) announced a partnership with Facebook on Tuesday and surged 36.9-percent. Climbing from $75.77 to $104.09.

#3. Viveve Medical, Inc. (VIVE) announced positive results from two studies on Tuesday. This news pushed shares up 34-percent during trading. Rising from $0.53 to $0.71.

#4. Jiayin Group, Inc. (JFIN) surged 33.3-percent after U.S. and China Phase 1 trade talks. Rising from $2.69 to $3.60 by the end of trading.

#5. Northern Dynasty Minerals Ltd. (NAK) has had two terrible days after a Wall Street Journal report suggested a planned gold and copper mine had been blocked due to environmental concerns. On Friday, August 21, NAK shares were valued at $1.45. By end of trading Monday they were $0.89, and by end of trading Tuesday they were $0.61.